tax liens in georgia list

Once a tax lien has been filed the Tax Commissioner may levy on the property. Fulton County Sheriffs Tax Sales are held on the first.

A Crash Course In Tax Lien Deed Investing And My Love Hate Relationship With Both Retipster

Check your Georgia tax liens.

. Federal tax liens are attached by the Internal Revenue Service IRS. You can then buy the tax lien property at a public auction. Within the state the.

Phone 912367-8105 Fax 912367-5210. A TAX SALE IS THE SALE OF A TAX LIEN BY A GOVERNMENTAL ENTITY FOR UNPAID PROPERTY TAXES BY THE PROPERTYS OWNER. Judicial Tax Sale List Currently Not Scheduled Contact Information.

A lien is a legal claim to secure a debt and may hamper the transfer of real or personal property. 69 Tippins St Suite 102 Baxley GA 31513. The process is a little more complicated than in some states.

Click Same-Day Wait List or Appointments to get started. Judicial Tax Sale List Currently Not Scheduled Judicial Tax Sale Photo List. The Department of Revenue may record tax.

According to the US. Tax lien auctions are conducted on the steps of the county courthouse the first Tuesday of the month. Buying tax liens at auctions direct or at other sales can turn out to be awesome investments.

Athens - Clarke County. Assuming a property is worth 250000 this equates to about 2393 per year. Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

Judicial Tax Sale List. Just remember each state has its own bidding process. If a property does not sell at a tax sale the property goes back into a rotation for future tax sale.

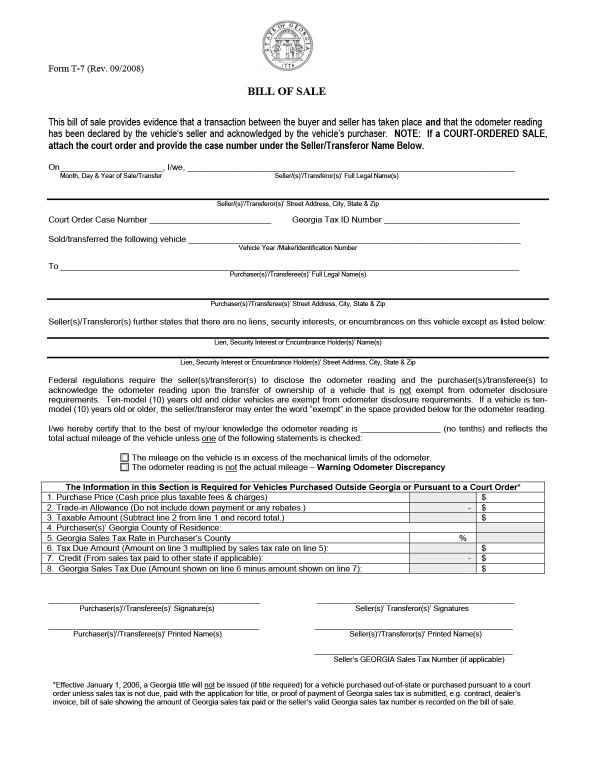

In Georgia the tax collector or treasurer will sell Georgia hybrid tax deeds to the winning bidders at the delinquent property tax sale. Cash bank issued cashiers check or bank wire transfer. What is a lien or state tax execution.

The Cobb County Tax Commissioners Office does not sell its Tax Liens or Tax Lien Certificates. This tool allows for searching for state tax liens and related documents that have been submitted by the Georgia Department of Revenue for subsequent acceptance and filing by a clerk of. Tax Deeds Hybrid Sec.

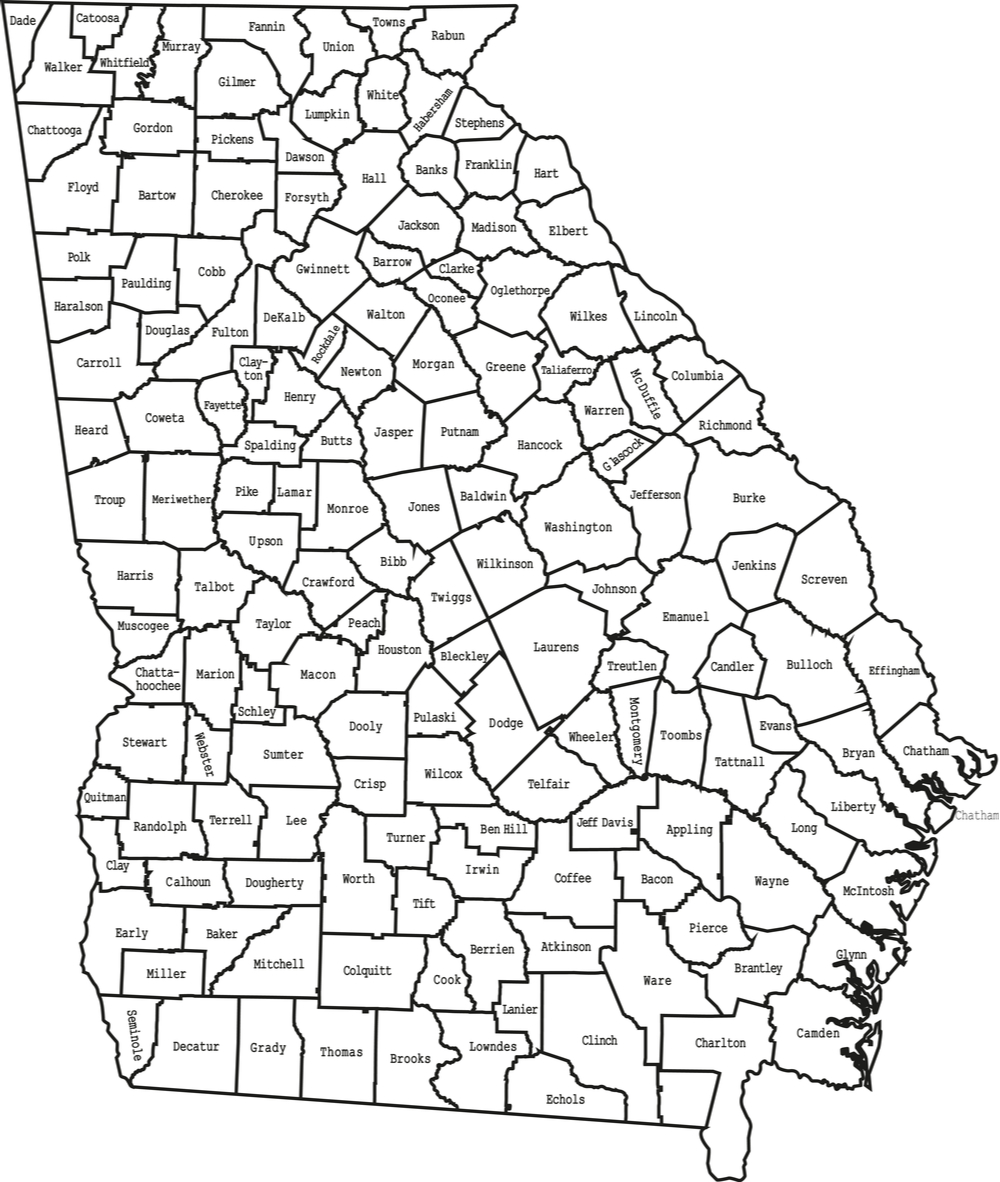

A levy of a tax lien is the act of setting aside a portion or a whole of a delinquent taxpayers property. Select a county below and start. In Georgia tax deed sales.

Georgia does not sell tax lien certificates. However Georgia has many tax deed sales. All payments are to be made payable to DeKalb.

Once scheduled for a tax sale only the following forms of payment are accepted. Treasurys annual report the IRS filed 543604 tax lien notices in 2019. Georgia homeowners pay an average of 0957 percent of their homes worth in property taxes.

Appling County Tax Commissioner. Smart homebuyers and savvy. There are more than 8446 tax liens currently on the market.

8 rows Georgia currently has 42104 tax liens available as of October 15. DeKalb Tax Commissioner.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Polk County Georgia Tax Commissioner

Georgia Sales Tax Small Business Guide Truic

Delinquent Property Tax Sale Greene County Ga

Georgia Bill Of Sale Templates For Autos Boats Firearm And More

Georgia Sales Tax Guide For Businesses

Georgia Tax Sales Redeemable Tax Deeds Youtube

5 17 2 Federal Tax Liens Internal Revenue Service

Chatham Files Tax Lien Against Savannah S Extreme Makeover House

Federal Tax Liens Atlanta Title Company Llc Br 1 404 445 5529

Georgia Tax Sale Property List Lien Loft

How To Find Tax Delinquent Properties In Your Area Rethority

Aads Is Your Source For Georgia Title Searches And Municipal Lien Searches All American Document Services

Georgia Mechanics Lien Everything You Need To Know Free Forms