salt tax repeal new york

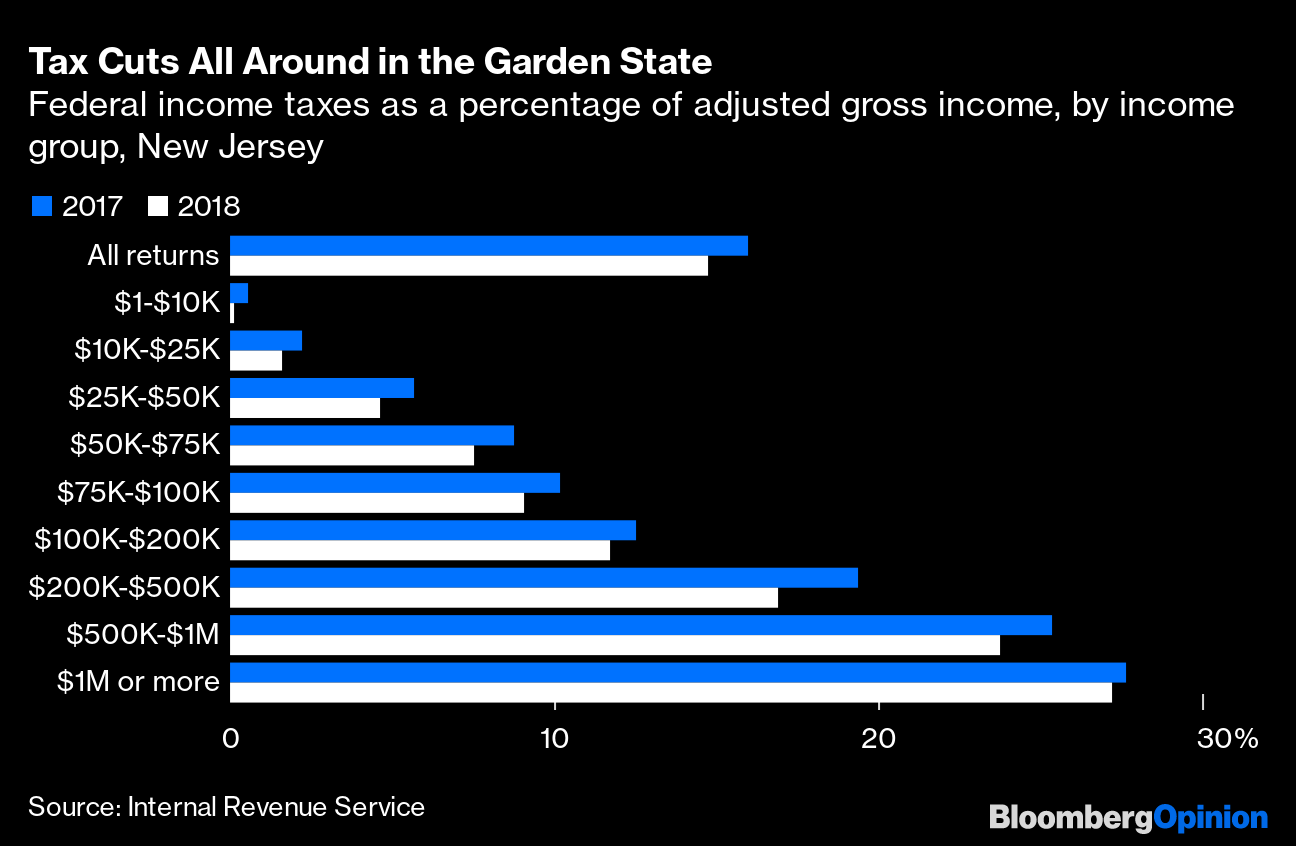

Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue. In 2018 Maryland was the top state at 25 percent of AGI.

Proposals To Overhaul The Salt Deduction Cap In Play Bond Buyer

The cap was implemented as part of the 2017 Tax Cuts and Jobs Act.

. On Friday the Wall Street. A cap on state and local tax deductions known as SALT may find its way back into the final text of President Joe Bidens 185 trillion spending bill. Americans who rely on the state and local tax SALT deduction at tax time may be in luck.

Bidens DOJ is trying to preserve the 10000 limiteven though. Blue states like New York and California want to restore the unlimited state and local tax or SALT deduction. Andrew Cuomos spin on the tax hikes in the state budget approved this month is this.

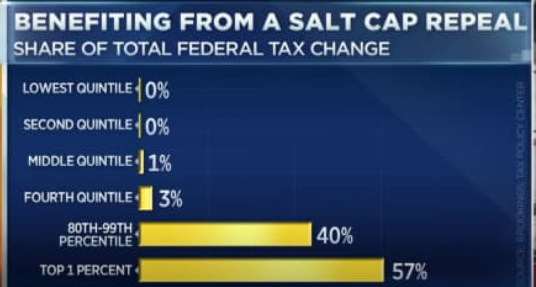

His 23 trillion American Jobs Plan already envisions a. 54 rows The state with the largest amount of SALT deductions as a portion of AGI in 2016 was New York at 94 percent. Only about 9 percent of households would benefit from repeal of the Tax Cuts and Jobs Acts TCJA 10000 cap on the state and local property tax SALT deduction Howard.

The federal Tax Cuts and Jobs Act of 2017 eliminated full deductibility of state and local taxes SALT effectively costing New Yorkers 153 billion. Tom Suozzi has taken a leading role in fighting to restore a tax deduction that is important to people who live in and around New York City and in doing so. They wont really count when.

A new bill seeks to repeal the 10000 cap on state and local tax deductions. October 05 2021. Salt tax repeal new york Wednesday March 9 2022 Edit.

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy How An 80. Cuomo said the repeal is the single best piece of action for the state of New York adding he hopes it will. Only about 9 of households would benefit from a repeal of the Tax Cuts and Jobs Acts TCJA 10000 cap on the state and local property tax SALT deduction wrote Tax Policy Center analyst.

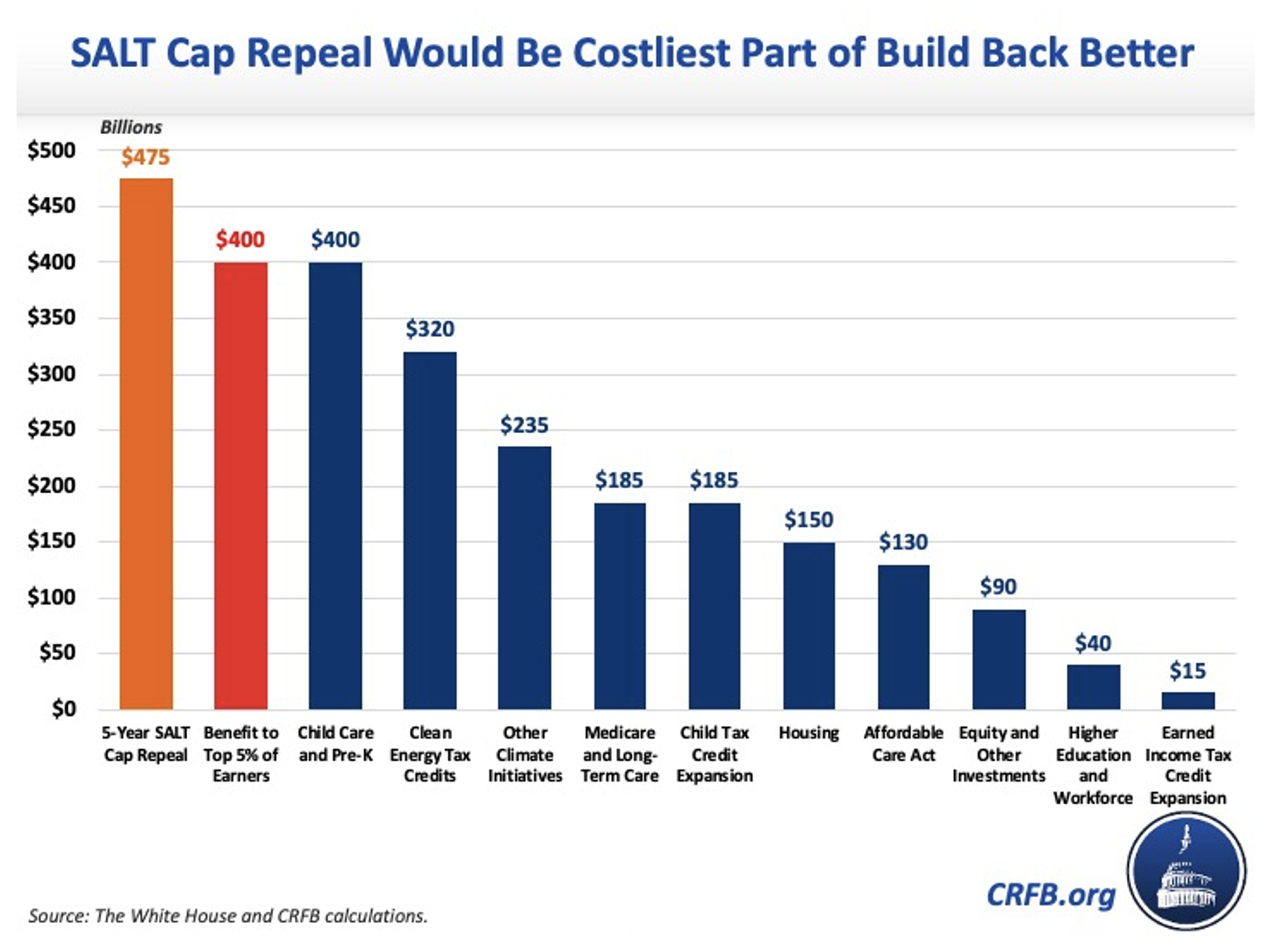

Most of the states House delegation threatened to oppose. Whats worse is that the law. Besides Biden has zero interest in repealing the cap since doing so would cost the feds 90 billion a year in tax revenue.

Residents of New York take the highest average deduction for state and local taxes according to IRS data. New Yorks SALT Workaround. New York is taking another run at repealing SALT cap.

As members of the New York Congressional Delegation we urge you to insist on full repeal of the limitation on the State and Local Tax SALT deduction passed by Congress in. New York seeks Supreme Court review of SALT cap. Democrats from high-tax states like New York New Jersey and California have spent years promising to repeal the cap and are poised to lift it to 80000 through 2030.

The decline from 2016 to 2018 was driven by the SALT deduction cap and to a lesser extent the drop in itemization due to the doubling of the standard deduction. Connecticut and New York have revived their efforts to overturn the SALT cap the federal deduction for state and local taxes that the Trump administration limited to. A bi-partisan group of county leaders from around the state joined with Congressman Tom Souzzi D-Long Island Queens and the New.

New York Democrats are turning up the heat on their party to repeal the cap on state and local tax deductions. New Guidance Affected Industries and What to Know Before the October 15 2021 Deadline. When that happens net taxes will.

Counties call for repeal of SALT cap. New York state on Monday made another attempt to overturn the 10000 cap on state and local tax deductions amid. The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes.

In 2014 3414 of New York tax returns included a deduction for. Cuomo said he has spoken to New Yorks congressional representatives and President Joseph Biden and fully expects a SALT repeal. That law the Tax Cuts and Jobs Act of 2017 did cut taxes for some but increased taxes on many not rich homeowners in certain states notably New York where it costs people.

Salt Deduction Cap Durbin Duckworth Restate Call For Repeal In D C Memo Crain S Chicago Business

Ny House Democrats Demand Repeal Of Salt Cap The Hill

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

The Salt Deduction There S A Baffling Tax Gift To The Wealthy In The Democrats Social Spending Bill The Washington Post

Dems Hike Taxes On Middle Class To Pay For 475b Salt Tax Shelter For Rich Ways And Means Republicans

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

House Democrats Propose Increasing Salt Cap To 72 500 Through 2031

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Urban Transporation Congestion Trends Sanjose Congestion Not Good Via Sanjosevoice Siliconvalley Congestion Urban Improve

Forgotten Flavors We Still Love Ben Jerry S Flavors Ice Cream

Everything Keeps Coming Up Roses For The 200 000 To 500 000 Set

Could The State And Local Property Tax Salt Deduction Limit Be Repealed In 2022 Under The New Stimulus Bill Aving To Invest

The Push To Repeal The Salt Cap The Long Island Advance

Gottheimer Suozzi Fight Aoc To Repeal State And Local Tax Deduction Salt Cap Bloomberg

Local Democrats Make Final Push For Salt Cap Repeal Bedford Ny Patch

17 New York Democrats Threaten To Oppose Tax Bill Without Salt Restoration

Salt Tax Increase That Burned Blue States Is Targeted By Democrats The New York Times